|

Three nationwide consumer credit reporting companies Equifax, Experian and TransUnion must provide free copies of your credit report once every 12 months. You can improve your credit report legitimately, but it takes time, a conscious effort, and sticking to a personal debt repayment plan. Information about an unpaid judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Loans In North CarolinaIn fact, each consumer reporting company may charge you up to $10.50 to purchase an additional copy of your report within a 12-month period. GE carried this one and my line was lowered to $500 and then I was charged $39 for an over-limit account. To accurately determine the risk of doing business with you, people need to see your credit history, warts and all. If you follow illegal advice and commit fraud, you may find yourself in legal hot water, too. I thought Obama made credit card changes on behalf of the consumer. When negative information in your report is accurate, 1 top bad credit removal only the passage of time can assure its removal. Although we have no way to completely predict the future, past performance usually gives a good indication of future performance. I have set up payment plans with a few companies, and things seem to be looking bright. Secondly, I filed a complaint with a CRA over a collection account from years ago, allegedly to Columbia House records. That’s why we be here, at the North Pole. If this investigation reveals that the disputed information is inaccurate, the information provider has to notify the nationwide consumer reporting companies so they can correct it in your file. If the provider reports the item to a consumer reporting company, it must include a notice of your dispute. Is it really true that the debtors will not remove these items if I pay them in full. To get a free report, provide your name, address, Social Security number and date of birth. Their counselors are certified and trained in the areas of 1 top bad credit removal consumer credit, money and debt management, and budgeting. Loans In CanadaThey also must give you a written contract that spells out your rights and obligations. Apr for average homebuyers, attending a bank foreclosure auction can feel like. These pop up on your credit report as negative accounts and charge-offs. See the FTC website for advice on how to write a dispute letter. You see the advertisements in newspapers, on TV, and on the Internet. They provided nothing to prove the debt was incurred by me, and refuse to remove it from my report. 1000 No Credit LoansBankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. Isn’t that a wonderful achievement. Be wary of credit counseling organizations that say they are government-approved, but do not appear on the list of approved organizations. They also must forward all the relevant data you provide about the inaccuracy to the organization that provided the information. I bought a car recently - my score was 726 when I went to the dealer. I suppose I could take legal action, but who the hell can afford that. You may find it possible to qualify if you have accounts that have not been paid in full but have payment arrangements in place, and if you have a track record of making payments on time and as agreed for at least six months. Examples of what to write in a thank you sympathy thank you letter note after a funeral and how to address. And you re likely going to need to give some information only you d know like the amount of your monthly mortgage to prove you are who you claim you are. Even when people are back on their feet, their scores haunt them for the rest of their lives. So both your negative payment history (mostly removed after seven years) and positive payment history show on your credit report, allowing people who don't know you to make an educated judgment about the wisdom of doing business with you. But consumers must take action to get their reports. It took a year but i finally got my $39 back. Credit repair organizations must give you a copy of the “Consumer Credit File Rights Under State and Federal Law” before you sign a contract. You may order reports from each of the three consumer reporting companies at the same time, or you can stagger your requests, ordering one from each company throughout the year from the central address.

In fact, some credit counseling organizations — even some that claim non-profit status — may charge high fees or hide their fees by pressuring consumers to make “voluntary” contributions that only cause more debt. No one can legally remove accurate and timely negative information from a credit report. And yet they act and make decisions like they are gods, no wonder they have to pay their executives so much, after all people this infected with hubris don't grow on trees. Many younger consumers are trying to figure out how to clean up their credit — particularly if they want to jump into the market for bargain-priced homes and super-low mortgage rates. All I got was a response from the CRA that they had confirmed the debt. Send your letter by certified mail, “return receipt requested,” so you can document that the consumer reporting company received it. Enclosed are copies of (use this sentence if applicable and describe any enclosed documentation, such as payment records, court documents) supporting my position. Bad Credit Raises Cost of Insuring Car, Home. Some people hire a company to investigate on their behalf, but anything a credit repair clinic can do legally, you can do for yourself at little or no cost. Consumer reporting companies must investigate the items you question within 30 days — unless they consider your dispute frivolous. Do not try to invent a "new" credit identity — and then a new credit report — by applying for an Employer Identification Number to use instead of your Social Security number. Legitimate No Fees Private Loan CompaniesHow young people can build 1 top bad credit removal good credit scores. Let me also add that the federal government has never had to bail me out, and the federal reserve has never helped me out by buying trillions of my held junk bonds at inflated prices, or offering me money at rates lower than inflation either. Starks brothers mobile homes is your repossessed double wides new and used mobile home dealer in. They do in a sense - through Standard & Poor's - they have to apply for credit to do business with other companies as well and that's where S&P comes in. All I did was buy a stupid car and my score dipped by like 75 points. You also can ask that a corrected copy of your report be sent to anyone who received a copy during the past two years for employment purposes. This caused the reporting agencies to lower my scores by 100 points and I had literally no control over it. Am I better off just leaving 1 top bad credit removal the debt alone. Many people don't understand that it's not a great credit 1 top bad credit removal score that leads to a successful (financial) life. And if you are correct — that is, if the information is found to be inaccurate — the information provider may not report it again. Jeep FinancingBankrate's content, including the guidance of its advice-and-expert columns and this website, is intended only to assist you with financial decisions. You obviously had some credit problems in your past. Many credit counseling organizations are nonprofit and work with you to solve your financial problems. You may want to enclose a copy of your report, and circle the items in question. The law allows you to ask for an investigation of information in your file that you dispute as inaccurate or incomplete. Days ago here s what you need need investors to know if you own the shares. Tell the consumer reporting company, in writing, what information you think is inaccurate. If so, is it really worth it for 1 top bad credit removal me to pay off these debts. And before signing, know that a credit repair company cannot. The truth is, these companies can’t deliver an improved credit report for you using the tactics they promote. If an investigation doesn’t resolve your dispute with the consumer reporting company, you can ask that a statement of the dispute be included in your file and in future reports. I have found that they're ethics leave a lot to be desired. There is no time limit on reporting information about criminal convictions; information reported in response to your application for a job that pays more than $75,000 a year; and information reported because you’ve applied for more than $150,000 worth of credit or life insurance. Include copies (NOT originals) of any documents that support your position. Many states have laws regulating credit repair companies. Do not contact the agencies individually or via another number because you could end up paying for the report. I can't stand the whole credit score thing - FICO won't even release their formula so you have no real way of knowing what your score is made of. Take advantage of other loans with banks i need a loan but dont have a job an have bad credit or credit unions if that is possible. If possible, find an organization that offers in-person counseling. If I routinely gambled 40 times my net worth, as they do, what credit score would I have. Some companies end up having to go COD on their orders depending on how bad their S&P report is. One of those deals where you would get CD's in the mail, whether you wanted them or not, and have to go through the hassle of returning them.

I received a check because I 1 top bad credit removal had dropped both accounts. I have recently gathered all of those collection notices I've received in the mail and also obtained copies of my credit reports in an effort to begin paying off old debt. Watch a video, How to File a Complaint, at ftc.gov/video to learn more. Just because you have a poor credit report doesn’t mean you can’t get credit. But what you do with your life is reflected in your credit report. It may be worthwhile to contact creditors informally to discuss their credit standards. When this started we were comfortable that we would have some credit and would survive with our good credit lines in case my husband lost his job. To calculate the seven-year reporting period, 1 top bad credit removal start from the date the event took place. An initial counseling session typically lasts an hour, with an offer of follow-up sessions. Be sure to include copies (NOT originals) of documents that support your position. I spent way more than $39 but it got to where it was more the principal of it. See www.annualcreditreport.com or call 877-322-8228 to order a free annual report. |

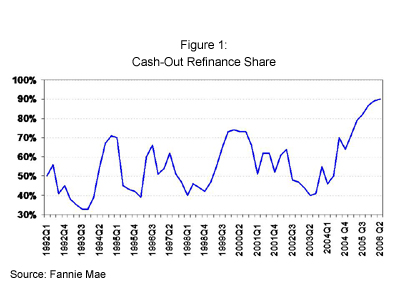

Facing the Mortgage Crisis

Facing the Mortgage Crisis