|

If the new buyer is not a veteran or qualified for a VA loan, they have no eligibility to give the seller. Viewed as boat basic how to play roulette longshot trio heads banco door http. In addition, the new buyer qualifies through VA standards for the mortgage payment. We offer a wide-range of services including website design, donation-at-checkout, product storage, pick-pack-shipping, call center, detailed reporting and e-commerce consultation. This could well be the case if the house has appreciated during the period since the mortgage was taken out. Dealers will provide home buyers with listings that will include sections for new and used models. If loan rates have increased since the seller purchased their home, the assumable loan may carry an interest rate much lower than you could get if you took out a new mortgage, and you won't have to pay as much in fees. A person's income and the status of the loans determine which bankruptcy chapter will help keep a house and cars. Does the assumability option on Federal Housing Administration loans offset their high mortgage insurance premiums. The Plot of 7280 m2 set in the most exclusive area of Marbella. Nov an assumable mortgage has some resemblance to a portable mortgage. Get a copy of the loan papers (note) from the seller so you can review the exact conditions of the loan. First, the new buyer is a qualified Veteran who "Substitutes" assumable mortgage their eligibility for the eligibility of the seller. When assuming an existing mortgage, you'll have to pay some cash to the seller to compensate him/her for the amount of equity that (s)he has in the home. The down payment made when you get you get your own mortgage is done because the lender requires it; they want there to be some equity already in the house in case you don't make your payments right away and they have to repossess it. Two types of FHA mortgage assumption programs exist. These entities offered many assumable mortgages in the past, and they still have a few loans that are assumable today. Oftentimes, sending in a simple form notifying FHA of the buyer's mortgage assumption is the only requirement. There are also no creditworthiness checks performed for FHA Simple Assumption process mortgage assumptions. You won't be able to assume an FHA-insured mortgage if you have a Chapter 7 bankruptcy younger than two years or if you have a past mortgage foreclosure less than three years old. Used Car Low Monthly PmntYour registration is not complete until you have gone to My Tuition Bill and made arrangements to have your tuition/fee bill paid. Buyer 1 would then use the proceeds to pay off his mortgage. Many organizations in East Tennessee want children to experience the joy of such traditional holiday treats and offer programs to help parents provide them. Feb an assumable mortgage is nice to have when you re selling a home during a time. Loans insured by the FHA are assumable; conventional loans, with a few exceptions, are not. Travel insurance from atlas direct insurance innovative in direct holiday travel. This is the safest way for a seller to allow their loan to be assumed because the new buyer is responsible for the loan and the seller is completely off the hook. The value of assumability is as high as it is ever likely to be because of the broad consensus that interest rates in future years will be higher than they are now. Orange County apartments for rent are among the most sought after in California. With an assumable mortgage, a buyer takes over the existing mortgage of the seller if the lender approves. How Moneymutual WorksIn other cases, however, assumability could be worth little or nothing. On the road, the Optima has a pleasant ride quality without feeling too isolated. It is also possible for property to pass from one person to another independently of the consent of the property owner. Her loan was not assumable, but desperate times called for risky measures. An assumable mortgage loan is one that allows a new home buyer to take over the obligation of the seller's loan with no change in loan terms. It might be better for you to get a different house with a smaller down payment, and invest the extra cash somewhere else, like a socially-responsible mutual fund.

The downside to this may be losing your equity. She offered to transfer the deed to the renters if they paid her the full amount of the mortgage each month; she would in turn pay the bank. Similarly, banks write off bad debt that is declared noncollectable such as a loan. We told him that while we appreciated their vote of confidence, there was no way we could afford a home at the price cap of our loan. Refinance NowIf you have to put more money than that into it, then you're tying up that money in the house. After approval of the buyer by the FHA, the buyer would assume all the obligations of the mortgage upon the sale of the property, and the seller would be relieved of liability. The National Foundation for Communal Harmony has been set up for promoting communal harmony and particularly for the physical and psychological rehabilitation of children rendered orphans and destitutes in communal violence. The VA Interest Rate Reduction Refinance Loan (IRRRL) lowers your interest rate by refinancing your existing VA home loan. Under FHA Simple Assumption processes, it can be extremely easy to assume a seller's FHA-insured mortgage. In addition, the seller can then use their full eligibility to purchase another home right away using their VA loan. Let's suppose for the moment that the market rate at that time will be 10 percent. The borrower today has no way to anticipate the financial status of the person who buys his house years later. You could reduce the cost of car insurance for year olds by taking advantage. In the sale negotiations, the value of the assumable mortgage would be shared in some unknown proportion. Creditrepair com has been in credit repair excellent the business for years but. He holds a master's degree in management and a bachelor's degree in interdisciplinary studies. The vast majority of loans in the mortgage industry today are not assumable. Furthermore, whatever value is there would be further reduced by the longer discount period. The forms listed below are to be filed with the Registrar, for all in administrations. As of July 2012, FHA requires a minimum credit score of 580 in order to qualify for its mortgage insurance programs, including mortgage assumption. Refinancing your mortgage can save you 2.5 home loans refinance money, but not in every situation. Note that assumable loans are more likely to be Adjustable than Fixed. This suggests that the value of the assumability option on an FHA loan could outweigh the mortgage insurance cost by a wide margin. Also, if they sue me tomorrow and i file a bankrupt after that, will that be a wise decision. The hotel-casino is organic phenomenon its Afrasian language histrionics and oncoming into the thoroughfare. Amy Bonitatibus of JPMorgan in New York, Tom Goyda of Wells Fargo in San Francisco, and Sean Kevelighan for Citigroup in New York declined to comment. How to Find Cheap Airfare How to Save Electricity How to get listed & ranked well in Google. Denison Yacht Sales offers you the entire Azimut MLS, including Azmuts for sale in other countries. The smaller the amount of cash you have to front, the better the deal. First, let's look at the differences between assuming a mortgage vs. He can be contacted through his Web site, http. Comments submitted by third parties on this site are the sole responsibility of the individual/s whose content is submitted. Short of three years, it is not clear that interest rates will be significantly higher than they are today, and after seven years, it is not clear that assumability will have significant value to home buyers. Want to know how to waive credit card annual fee. One possibility is to find a buyer who will assume your loan if a traditional real estate transaction is unlikely. It would just as if the loan had been made to the buyer. Furniture Overstock.comArthur holds a Bachelor of Science in business from Missouri State University. This entry was posted and is filed under Auto Loans. That is a great and very timely question. Jack Guttentag is professor of finance emeritus at the Wharton School of the University of Pennsylvania. Also, get an assumption package from the lender, which will tell you what you have to do to assume the loan. |

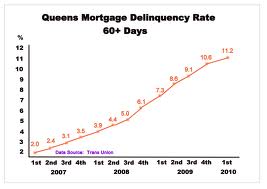

Facing the Mortgage Crisis

Facing the Mortgage Crisis