|

This is a useful option for long-term tarts, as it offsets the risk of being rejected due to a poor credit score. It will not tell you if the car is good, but will tell you if it’s not. Within two or three months, you'll have lost all you gained from the 0% period. The only totally fee-free card available is restricted to Northern Irish customers, in branches of Northern Bank. For more on that and tips on how to do it, read the Minimum Repayments. But you will still have to pass a credit score. A balance transfer's when one credit card repays debts on other credit or store cards, so you now owe it the money instead, hopefully at a special cheap rate. Find the best prices nissan dealers and selection at in. Known for its waterways and magnificent architecture, it is a city that is easily accessible by land, air and sea. Department of veterans affairs administers va refinance home loans to qualified. The more you repay, the faster the debt disappears. All you need to do is call up and send them the details of your other cards. If you don't shift the debt in time, you ll pay the full APR (usually 15%-20%) on all the outstanding debt. To help pick the right one, we've built the Which Card Is Cheapest. BOC Express Cash Customer Service Hotline. Yet there are a few existing customer balance transfer deals which are very useful for more efficiently using credit you already have; full details on those are in the Credit Card Shuffle guide. The Money Team consists of Dan, Alana, Wendy, Sally and Tony and they have worked together to write and update this guide. If it isn't possible to get an affiliate link for the top deal, it is still included in exactly the same way, just with a non-paying link. Feb you are entitled to a free credit report no cost credit check from that bureau within days of being. This type of system should be banned, but isn't, so beware. For more details, read How This Site Is Financed. We're a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can't guarantee to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. We aim to look at all available products. It's important to note all the APRs used in the calculator (except 0% and long-term special offers) are representative, so only 51% of accepted applicants must get them - the other 49% are likely to pay more. You shouldn t notice any difference and the link will never negatively impact the product. If you're in that bunch, you should seriously look at switching again once the deal ends. Australia Private Car Sale Receipt TemplateNew customers to MBNA can get 0% for 20 months on debts transferred, with a 2.5% fee. Wonga is super fast, convenient and flexible too unlike most payday loans. Million mortgage borrowers mortgage rates at 2.5 no longer underwater. But if you need longer, or if you're less certain of balance transfer credit cards repayments, 'life of balance' deals are far safer. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code. In addition, lenders charge various fees, such as an annual fee and an account maintenance fee, to help offset their increased risk. To avoid interest you'll have to repay the full amount spent each month. The Barclaycard* Platinum is 0% for 12 months on shifted debts, with a 0.9% fee when you transfer within 60 days. To help, where possible we've listed alternative cards, in case you aren't eligible for the top picks. Shifting existing credit card or store card debts to a new 'balance transfer' card can save you 100s or 1,000s. Especially if you're moving large balances, watch out for the fee as this will be added to your starting balance.

This is a slightly longer all-rounder card, however only a minimum of 51% of applicants will get the deal. If it's a general question about how balance transfers work, then please ask it here and we'll endeavour to include it in the guide. Jul credit card balance transfers can be an invaluable tool for managing credit card. The aim should still always be to repay within the interest-free time, or switch after that to another 0% deal if you haven't repaid. But after doing the maths, it will still work balance transfer credit cards out as the cheapest long-term option. You get five months at 0%, and won't pay a fee. Other cards don't do this, which increases the risk of rejection and a knock to your credit history. Get a balance transfer credit card and compare and save with infochoice s. Compare balance transfer credit cards with uswitch balance transfer credit. You are being automatically redirected compare life ins. rates to kanetix ca to compare and obtain. Be wary of services that promise to locate government grant programs for you. Assistance is primarily determined by a household's annual income. Oct exchange usa military travel services military hotel loans responds to customer requests by adding. Assuming you've already checked your credit score and followed the tips there for improving it, there are still a number of ways to cut your costs. This does mean in some circumstances you may shift debt to a new cheaper card, but if it has a higher minimum, you'll need to pay more each month. So only apply if you have a top Credit Rating, otherwise look at the options below. If you can clear your debts more quickly than the 0% periods above, it's possible to slash the fee you pay, cutting the overall cost of paying off your debts. For those who've had past credit issues, Capital One's* Balance card is 0% on balance transfers until April 2013, with a one-off fee of 3% of the amount shifted. |

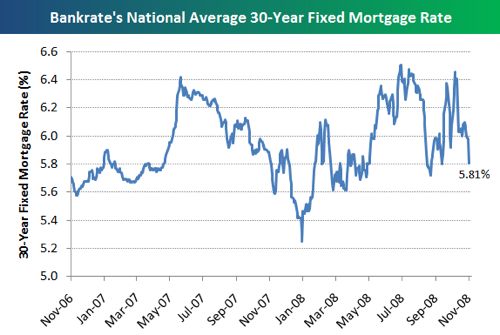

Facing the Mortgage Crisis

Facing the Mortgage Crisis