|

The information contained herein is not legal advice. Get advice on rebuilding your credit rating after your bankruptcy has been. This, of course, will help you obtain more credit if you need it. In fact, for those consumers who have rental data reported, 45 percent of them with VantageScores in the 500s and lower found their scores increased to 600 or above, RentBureau's Johnston says. And don't let anyone make you feel that way. This is a very inexpensive loan (interest rate usually only about 2% above your savings rate) and, while technically not providing you with new cash, it will quickly help you reestablish your credit after bankruptcy. L dohc valve i force carros en puerto rico v engine inc. Subastas Autos Citibank Puerto RicoMortgages guaranteed by the Federal Housing Administration are permitted one year after a consumer exits a Chapter 13 bankruptcy reorganization, which requires a repayment plan that is often a fraction of what is owed, and two years after the more common Chapter 7 liquidation, which discharges most or all debts. Since you have been discharged, you are not allowed to file another petition until eight years have passed. Do not use the form to submit confidential, time-sensitive, or privileged information. That said, a bankruptcy could help your score over the long term, as well. A personal bankruptcy filing will have a larger impact on a credit score than any other credit issue, according to a July report by VantageScore, which provides credit scores to lenders. Make sure all the accounts you included in your bankruptcy are listed as such, and show $0 balances if you filed Chapter 7, says Detweiler. Car payment receipt template download on gobookee org free books and. That said, if your debt payments are crushing you, bankruptcy will give you a much-needed fresh start. You eventually will get approved for loans, even car loans and mortgages, but your post-filing behavior and effort will produce available options. Your credit score won't reflect anything except your bankruptcy. Buying A House After Bankruptcy In Houston TxDow Jones Indexes (SM) from Dow Jones & Company, Inc. Explore thousands of used cars and used car prices at kelley blue book. Compare the best latest us credit card offers apply today. You already know that credit can be risky, and you've probably learned that you can expect to pay higher interest rates shortly after filing bankruptcy, so why would you want to apply for new credit at all. Typically, after a year to 18 months of on-time payments, you could "graduate" to a regular, unsecured credit card. Both types of bankruptcy affect your credit score in the same way, according to Ulzheimer. Though bankruptcy remains on your credit report for seven to 10 years, you can start to turn your credit around in 12 to 18 months, experts say, by considering the following options. Sep fortunately, there are many credit cards for bad credit after bankruptcy that can. Any information you submit to Total Bankruptcy does not create an attorney-client relationship and may not be protected by attorney-client privilege. You must remember that you can get credit again, but it will take some time. Credit dings, especially ones as big as a bankruptcy, give the lender all the incentive needed to reject you for a loan or financing. Remember this quote and repeat it as often as possible. Right after you receive your discharge, you can procure one or more secured credit cards from a number of card issuers. As a result, credit scores can run credit after bankruptcy the gamut among bankruptcy filers. Any bonafide student of up baguio. It may initially be hard to get good rates on new credit cards, but it can be a good idea to get one or two cards and -- this is important. While the last thing you may want to do is pull a copy of your credit report to see the bankruptcy's damage firsthand, it's important to make sure inaccuracies don't drag your score down even more. Earlier this year,, credit reporting agency Experian announced it would include rental histories in its credit profiles to get a more accurate reflection of consumers' financial pictures. Create a news alert for "bankruptcy" advertisementRelated Links. Restoring creditWhich bankruptcy is best.Creating an emergency fund. Mutual Fund and ETF NAVs are as of previous day's close. Mar rebuilding your credit after bankruptcy will take time. It might seem that if you stick to cash, you "can't get into debt trouble again", but it's important to not give up on credit just because you filed bankruptcy papers.

It does not make any representation and has not made any judgment as to the qualifications, expertise or credentials of any participating lawyer. Then again, your credit score alone shouldn't affect whether or not you decide to file bankruptcy. If a creditor continues to report the account as delinquent which they shouldn't your credit score would suffer. There are some sources of loans after bankruptcy although your choices will be rather limited. Here are thank you letter samples, and email message examples, for a variety of. These cards are either totally or partially “secured” by your own funds. Onemain Financial LoansThe content is broad in scope and does not consider your personal financial situation. Total Bankruptcy does not endorse or recommend any lawyer or law firm who participates in the network nor does it analyze a person's legal situation when determining which participating lawyers receive a person's inquiry. A discharge in bankruptcy will not automatically prohibit your approval, but the owner still needs some confidence that you will make scheduled rent payments as agreed. Even a smaller purchase, like a new vehicle, may require financing. As you begin the credit repair process, you will need to explain yourself to potential lenders over and over and over again. The simple answer is that certain purchases in our society virtually require credit. Carros Usados En GuatemalaThis copy is for your personal, non-commercial use only. One of these score cards credit after bankruptcy is bankruptcy filers. In reality, they could become eligible in as little as one year, as long as they work diligently to improve their financial picture. Learn how to get a credit card with bad credit from our experts. Research shows that the vast majority, more than 80 percent, of individuals who file bankruptcy have dealt with an illness, a divorce or a period of unemployment. By keeping on top of payments on those remaining loans, you'll receive a credit boost for paying your bills over time. Jacqueline Gikow of New York found this out the hard way after she filed for bankruptcy and then decided to operate solely with cash. Distribution and use of this material are governed credit after bankruptcy by our Subscriber Agreement and by copyright law. If a bankruptcy filing was the result of a one-time occurrence, like the death of a spouse, divorce or illness, the waiting period to apply for a mortgage may be reduced. As you make your scheduled payments in the coming months, your credit limit will normally be increased at regular intervals. The institute data noted that last year there were 1.362 million personal bankruptcy filings nationwide, down from 1.53 million in 2010, and closer to the norm over the last 15 years. Credit Card Cash AdvancesBankrate's content, including the guidance of its advice-and-expert columns and this Web site, is intended only to assist you with financial decisions. If it doesn't, contact those creditors and the credit bureau to make sure the information gets updated. A high interest card with no annual fee, in general, can be advantageous if you use it regularly and pay it off immediately so you rack up no interest charges, Ross says. While bankruptcy information should not normally appear in the data base, if there were circumstances that may have caused problems with your previous checking account, you may need to explain the situation before you'll be allowed to open the account. Traditional banks are likely to turn you down, but the financing folks at the dealership may be more lenient, especially if they're in a bind to meet sales quotas. If you can't get approved for an unsecured credit card, start out with a secured card. You need to prepare a 30- to 40-second sound bite, explaining why you filed for bankruptcy. |

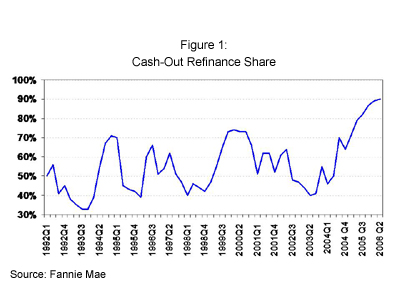

Facing the Mortgage Crisis

Facing the Mortgage Crisis