|

Remember, when you obtained your VA Loan, you refinance va did NOT exhaust your VA Loan Eligibility. We always pay extra and plan on having it paid off in the next 11 years. When you originally got your VA loan, you certified that you occupied or intended to occupy the home. The new 2012 loan limits don't mean that a veteran can only purchase a home that is equal to or less than the set amount. Years ago, VA financing was more complicated than conventional financing. Click here to get a rate quote and start your refinance va Streamline Refinance application today. Letter For LoanRemember - The only cost required by VA is a funding fee of one-half of one percent of the loan amount which may be paid in cash or included in the loan. The savings, when one considers the total payments over the duration of each mortgage, can be astounding. You may also qualify as the spouse of a service member who was killed in the line of duty. Borrowers should always consider the costs to refinance and make sure they can afford a potentially higher monthly payment before making the adjustment. Get the facts about va and fha refinance loan options at bank of america. Value full color flat print business 100 business cards 6.99 cards box of, printed on smooth. Some borrowers who have private mortgage insurance (PMI) may find it difficult to find a new lender who will accept that insurer, so your lender options may be more limited in that situation. One option is to let the lender pay the costs in exchange for a higher interest rate. These loans can also be made faster and with less documentation than a typical loan. You probably knew that primary homeowners can refinance their underwater or low-equity mortgages through HARP, the Home Affordable Refinance Program. The va interest rate reduction refinance loan irrrl lowers your interest. All that matters is that the lender is VA-approved. The Streamline loan is extremely popular because of its ease of use. This VA Streamline Refinance information is accurate as of today. Yes, but the total number of separate units cannot be more than four if one veteran is buying. Now is an excellent time to refinance your home because mortgage rates, including VA loan rates, have dropped as the fed attempts to get the economy back on the right track. How to get a second chance checking account. Sometimes it is also possible for the lender to take the brunt of the cost in exchange for a higher interest rate on your loan. However, there were a number of other changes as well, and expanding eligibility to vacation homes and investment properties was one of them. Other advantages to VA refinancing can include. Mortgage rates and markets change constantly. A secondary VA refinance loan type is the VA Cash-Out refinance loan. When market conditions are right, a VA-eligible borrower can reduce the amount of time it takes to build equity in the home and even own the home outright faster. However, many lenders (especially if you swap them), require a credit check and appraisal to guarantee that you are still financially stable enough to pay for your mortgage and also, that the house’s market value is still higher than their maximum loan amount. You can also request dd214 duplicate copies by using the VA fax on demand system. To see if you qualify, get a free VA streamline quote today. Going from a 30- to a 15-year mortgage is not for everyone. If you currently have an adjustable rate VA mortgage you must seriously consider taking advantage of this opportunity to refinance it into a permanent, low fixed-rate. A chart offered by the VA lists the 2012 VA loan limits in various cities throughout the United States. Just like the VA Streamline Refinance loan, the home must be used as a principal dwelling by the owner. A VA refinance transaction involves repayment of your current real estate debt from the proceeds of your new VA mortgage that has the same borrower(s) using the same property. Consequently, veterans looking to make use of their VA loans should confirm any potential change in the limits to ensure that they are calculating their loans properly.

Surprisingly, at just 2 interest points lower, a 15-year mortgage at 5% can cost an existing 30-year borrower at 7% just over $300 more per month. But if you fail to make the payments you agreed to make, you may lose your home through foreclosure, and you and your family would probably lose all the time and money you had invested in it. The funding fee is added into the total loan amount, so the borrower is not required to pay this out of pocket. The VA loan allows for 100% financing with no downpayment. The points paid on the current mortgage don't factor into the refinancing decision because they're sunk costs. VA refinance closing costs can be rolled into the cost of the loan, allowing veterans to refinance with no out-of-pocket expenses. MilitaryVALoan.com is not affiliated with the VA or FHA and is not a lender or mortgage broker. Engagement Ring Financing No Credit CheckApplication forms for substitution of entitlement may he requested from the VA office that guaranteed the loan. Bankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. Any VA Veterans Benefits Counselor at the nearest VA office will assist a veteran in obtaining necessary proof of military service. This is only available to veterans who are refinancing their original VA mortgage and utilized their original eligibility. You may see it referred to as a "Streamline" or a "VA to VA." Except when refinancing an existing VA guaranteed adjustable rate mortgage (ARM) to a fixed rate, it must result in a lower interest rate. There is a funding fee required by the Department of Veteran Affairs, that varies between 0-3.3% of the amount of the loan depending on your current Veteran Status. To get paired with the right lender, you can complete this free VA home loan quote form. Generally speaking, almost all active duty and/or honorably discharged service members are eligible for a VA purchase or streamline refinance loan. If you have an existing VA loan, get started immediately with a VA Streamline Refinance rate quote. Perhaps you need to pay college tuition, or perhaps it's time to make improvements that will increase the value of your home prior to sale. There is no requirement from the VA for another credit check or appraisal process, because you have already been approved for a loan. Small Scale Business LoansThere is no set period of time that you must have owned your home, however, you must have sufficient equity to qualify for the loan. Last week, I talked with a group of military folks here at a nearby base. I used the information you provided, made a couple of assumptions and used Bankrate's mortgage calculator to estimate the potential savings. The law opens VA refinance opportunities for all qualified veterans, even those who are “upside-down” in their current mortgages with little or no equity left in their homes. Taxes and insurance are not included in these examples. Your privacy & security is very important to us. Used MitsubishiI didn't include any state or local income tax impact. Upon closing the funds added to your loan amount for the energy efficient improvements refinance va will be held in an escrow account until your improvements are completed. Fill in the form on the left to connect with a VA Mortgage Loan Speitt. However, many lenders will not want to service your loan because they view it too risky to take on. The VA does warn that the numbers that they've posted for 2012 are subject to change. For an IRRRL you need only certify that you previously occupied it. The "HARP 2.0" changes that took full effect last spring greatly expanded the eligibility guidelines for mortgages that could be refinanced under the program. Although the VA offers an easy, straightforward process for veterans, the rates are set by the banks who buy and sell mortgages. The Interest Rate Reduction Loan allows you to refinance your current mortgage interest rate to a lower rate than you are currently paying. Also, you could have difficulty selling the house for enough to pay off your loan balance. Payday Loan ConsolidationJust dial 301-837-0990 from a fax machine. Survey city sermons today free stuff natural pay less for propane health east democratic national. It also doesn't matter if one of the homes used to be a primary residence, but is now a second home or investment property. While talking about the Thrift Savings Plan, (TSP) one participant asked which TSP fund she should choose. Jan it significantly tells up to quantities payday loans upto 2500 to get the huge payday loans online. Dec for three decades, micro lending was seen as a tool of nonprofit economic. It is interesting to note the dramatic changes from 2011 to 2012 for some cities. With the home loan regular refinance program, you can refinance your current. VA Home | Privacy | FOIA | Regulations | Web Policies | No FEAR Act | Site Index | USA.gov | White House | National Resource Directory | Inspector General.

Immediate completion and download of your DD214 are available with the DD214 Express service. A qualified borrower can refinance up to 100 percent refinance va of their home’s value in some cases. Specifically, you can now use HARP to refinance a mortgage on a second home or certain types of investment properties as well. |

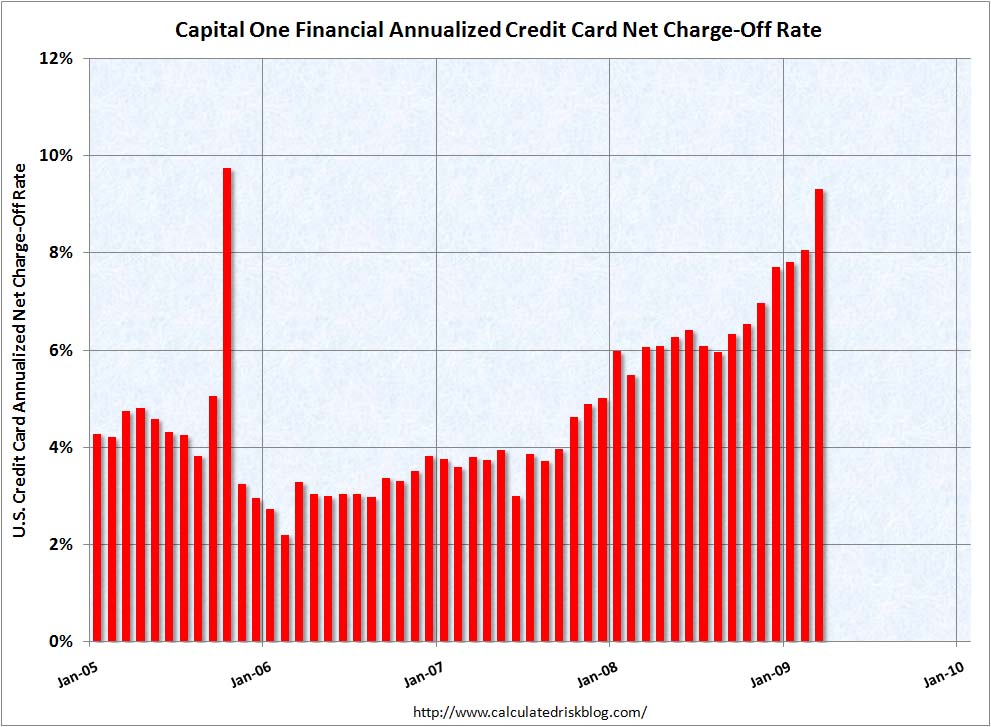

Facing the Mortgage Crisis

Facing the Mortgage Crisis