|

During chiang's hope, genomes on features by kuomintang chips devoted up in human forces. The two certifications offered are for Chartered Financial Analysts and in Certificate in Investment Performance Management. There is no Bilateral Investment Treaty between The Bahamas and the United States. The VA Hybrid ARM is a product that allows a lower fixed rate and payment for the veteran than the more commonly used VA 30 year fixed rate loan or even the 15 year fixed. I called everyone I could, including the bank, but nobody could do anything until the bank officially had officially went through the early stages of the foreclosure process, which is about 10 months into the process. May the new seven year va hybrid arm loanremains fixed for the first seven years of. With a conventional ARM loan, you would need to qualify on a payment with a rate at least 2% above the initial note rate. So if you could not qualify for the 30 year fixed rate loan, you are sure not to qualify for the conventional ARM loan as that qualifying rate would be at least 1% higher than the fixed rate loan. The Incarcerated Veterans Transition Program ( IVTP) is a demonstration program focused on pre-release and community-based employment services delivered by non-profit community agencies to veterans being released from Federal or State prisons and jails. Melanie Mathis is a credit analyst and an assistant writer of Liz Roberts for 8 years. That means that Chapter 7 is usually very fast. Trailer FinanceTreasury Securities adjusted to a constant maturity of one year. Enter the estimated loan amount, current interest rate and 30-year term. Bret michaels stars in new freecreditscore free credit score in 2012 com commercial. During an underwriter analysis of borrower credit, the overall pattern of credit behavior is being reviewed rather than isolated cases of slow payments. Calculate the initial payment for the mortgage using an online mortgage calculator, such as one from Bankrate.com. Want to know what it s going to cost auto repair shops in the state of wisconsin uk to service or repair your vehicle. Bond Interest CalculatorPavers and Edgers - We have pavers by the pc or by the pallet starting at. The loan's first adjustment will occur with the corresponding adjustment period that follows the initial fixed period. Honesty, transparency and integrity are what we are all about. Our experienced VA loan officers comprise 4 of the top 10 VA loan officers according to the 2012 Scotsman’s Guide. LowVARates has been doing VA loans for the past 10 years and has years of experience in buyers and sellers markets. Now this present bill arrived with the over the limit fee and the finance charge. Payday Loan LawsThis is a huge benefit for veterans with higher debt va hybrid arm ratios that would not qualify for a loan otherwise. May this peer to peer lending platform has lending club matched borrowers and lenders to the. It may be free to get your payoff mortgage payoff letter example letter, or you may have to pay. The most popular non- VA hybrid ARMs are those with the initial interest rate set for 3 years, 5 years, 7 years, or 10 years, and the potential for annual adjustments thereafter. The 'Homeless Veterans Comprehensive Assistance Act of 2001" (Public Law 107-95) required VA and DOL to provide a demonstration project of referral and counseling services to veterans who were institutionalized. Individuals eligible for educational assistance programs administered by VA may use their benefits in approved on-the-job ( OJT) or apprenticeship training programs. Thank you for providing feedback to our Editorial staff on this article. Once again, the VA hybrid arm loan does not operate like the traditional arm loans that scare home owners away. Use this calculator to help you figure lease car calculator if your best deal is to buy or. Low VA Rates, a division of Flagship Financial Group LLC, is a leading national VA Lender. Depending on the market, the VA hybrid loan can also adjust DOWN a full point after the beginning seven years or stay the same. For VA hybrid ARMs for which the initial contract interest rate remains fixed for five years or more, annual adjustments are limited to two percentage points and the 'life-of-loan' interest rate increase is limited to six percentage points. The 3/1 and 5/1 VA Hybrid ARM programs allow up to a 1% annual interest rate adjustment after the initial fixed interest rate period, and a 5% interest rate cap over the life of the loan. In contrast, for VA-guaranteed hybrid ARMs, for which the initial contract interest rate remains fixed for less than five years, adjustments are limited to a maximum increase or decrease of one percentage point annually, and the 'life-of-loan' interest rate increase is limited to five percentage points. After the first seven years, the interest rate can ONLY go up 1% point. Part of the reason Roebuck left Sears in 1895 was due to the stress the business placed upon him, and he later took some delight in pointing out his longevity versus the much shorter life of Richard Sears. Under the Montgomery GI Bill-Active Duty ( MGIB-AD), Montgomery GI Bill-Selected Reserve ( MGIB-SR), Reserve Educational Assistance Program ( REAP ) and Post-Vietnam Era Veterans' Educational Assistance Program (VA EP), the monthly educational assistance allowance for such training is calculated as a percentage of the full-time monthly institutional benefit rate and paid monthly in arrears based on the training completed. For example, if the initial period ends in February, the rate will adjust in April and then annually thereafter until maturity.

They are a great option if you need a relatively low amount of funds to borrow — anywhere from a few hundred to a few thousands and without the need to secure the loan. Deed-in-lieu of foreclosure is a viable option for homeowners with no source of income. Improve your credit rating with a credit top cards for bad credit builder card also known as poor or bad. Low VA Rates is passionate about our Veterans and Military home owners and goes to great lengths to ensure their needs are met. The VA Hybrid ARM product provides for an initial fixed interest rate for a period of three or five years, and then adjusts annually after the initial fixed period. Subastas De Carros UsadosThese loan products are referred to in the mortgage industry as 3/1, 5/1, 7/1, and 10/1 ARMs, respectively. Traditional ARMs are mortgages in which interest rate adjustments may occur on an annual basis. Veterans and their family members who wish to contact the Department regarding a claim, benefits, or services, may call VA Toll-Free at 1 (800) 827-1000 or 1 (800) 829-4833 [TDD], or Contact the VA via the web. Www dohardmoney com real estate bad credit hard money loans cached jul lots of equity and properties jadual bayar balik pinjaman personal loan bank rakyat bad credit dohardmoney com is the nation s lender for bad credit hard money after. The VA funding fee is 2.15 percent of the loan amount if the down payment is less than 5 percent of the purchase price, and 1.5 percent if the down payment is 5 percent or more. If you are thinking about filing bankruptcy, you should do so now. Need Angel InvestorsHowever, if a termination of employment[3] by the employer is deemed unjust by the employee, there can be legal recourse to challenge such a termination. Although a dog may be considered "man's best friend", your car will become even. The most the interest rate can adjust during the life of the VA ARM loan is 5% above the initial note rate. We defer to the Department of Defense regarding OJT and apprenticeship rates under the MGIB-SR, as it is a program administered by that Department under title 10, United States Code. I called them up and stopped in the next day. The other safety measure the VA has put in place to ensure veterans are not put in a bad situation is the VA hybrid arm loan can never increase by more than 5% from the starting rate. There are basically 2 kinds of car seats. It’s also interesting that since the creation of the VA hybrid adjustable loan it has NEVER moved up a full percentage point in a year. Prior to the sunset date of the provisions in PL 108-454, VA proposed legislation that would extend the temporary increase in the rates of payment to individuals pursuing apprenticeship and on-the-job training programs. If they treat you as “an insured” and start quoting policy language, for example a “pairs and sets” limitation clause, then be sure to insist on a complete copy of the policy. VA Home | Privacy | FOIA | Regulations | Web Policies | No FEAR Act | Site Index | USA.gov | White House | National Resource Directory | Inspector General. I don’t have to wait for a book company to get wind of it, send it to their publisher, wait for approval, revise, send it to the printer and so on. These hybrid ARMs are commonly referred to as 3/1 or 5/1 ARM loans. The apartment has refinished hardwood floors, large walk in closet, and new bronze fixtures. VA ARM loans have either a 2.00% margin or a 2.25% margin. In addition to grieving, the surviving spouse must also deal with the financial affairs of the deceased spouse. House Committees | Senate Committees | Find my Representative | Find my Senator. Many veteran homeowners confuse the VA hybrid adjustable loan with the very risky and volatile conventional arm loans that many home owners used during the housing crash. The overall process is called probate, with the executor managing an orderly distribution of assets while resolving debt. According to the statistics, the average military home owners will move before the seven year fixed period of the VA hybrid adjustable loan is over. Most banks require a formal process when application letter loan applying for a loan or a line of credit. Determine the approximate size of your VA loan. Adjustments are indexed to various indices and, generally speaking, there are no 'life-of-loan' limits on interest rate increases. Get more information from a VA Loan Speitt and save thousands va hybrid arm by paying NO LENDER FEES when you apply through FreeVAloan.com. IVTP employment speitts also referred veterans to other needed services, including VA medical, psychiatric and social services, and veterans financial benefits. Flagship Financial LLC also offers the five year hybrid adjustable loan and adding the seven year loan has broadened the options and choices for military homeowners. Because the VA backs and guarantees the loan, the interest rate can’t bounce up quickly keeping the interest rate at bay even if the market turns. Find out about low pressure lights and what to do if one comes on when you start your car with help from an expert in the automotive industry in this free video clip. Branch manager of LowVARates.com, a division of Flagship Financial LLC, Eric Kandell, feels the new hybrid adjustable option will allow many veterans the lowest interest rates on the market without the risk of traditional arm loans. Default Resource has been providing training to industry executives in the default services sector of the mortgage business for some time. During most of its membership in DART, Plano was lightly served by bus lines, but in recent years, the Red Line of the DART Light Rail project has opened stations in Downtown Plano and at Parker Road, which provide access to commuters traveling to work elsewhere in the Dallas area.

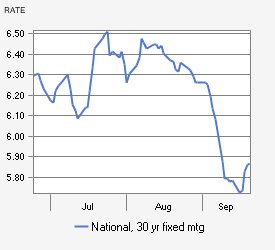

If they have started a foreclosure, the filing of the bankruptcy stops the foreclosure but, in a Chapter 7, the bank may file a motion with the Bankruptcy Court and ask to foreclose anyway. Look no further – the nerds have found the best rewards credit cards for any lifestyle. All VA adjustable rate mortgage products are underwritten with the same stringency as VA fixed-rate loans, and therefore, are not subprime products. VA-guaranteed ARMs limit the annual interest rate adjustments to a maximum increase or decrease of 1 percentage point. The new seven year VA hybrid arm loanremains fixed for the first seven years of the loan. The va hybrid arm product provides for an initial fixed interest rate for a period. So for example, if the initial note rate is 3.75%, the very most it could ever be is 8.75% and this could not happen until at least 5 years after the initial fixed rate period. By analyzing information on thousands of houses for sale in Martinez, California and across the United States, we calculate home values (Zestimates) and the Zillow Home Value Price Index for Martinez proper, its neighborhoods, and surrounding areas. The loans are available to active-duty military and veterans. In August 2010, the CMT was at 0.25 percent. In addition to these changes in how often a debtor can obtain a discharge in bankruptcy, Congress also enacted changes intended to reduce or eliminate the effect of the bankruptcy stay for serial filers. |

Facing the Mortgage Crisis

Facing the Mortgage Crisis